IT

Infrastructure

|

| Source: pixabay |

One of the distinguishing features of Korean culture is the

‘Bbalee Bbalee’ culture, which translates to ‘fast and faster’ culture. Korea

is believed to have the fastest and easiest accessible internet systems in the

world.

Korea is known to have a robust IT Infrastructure facilitated by the population density in large cities. Close to 50% of the population lives in the Seoul Metropolitan area which makes free, high-speed Wi-Fi easier to deliver than in other countries.

Most cafés and restaurants have free Wi-Fi and all mobile phone companies provide free Wi-Fi in subways. While the internet is essential to everyone, the dominant mode of access is shifting from computers to mobile devices. As a result, the penetration rate for computers per household is actually decreasing.

Source: Korea Communications Commission

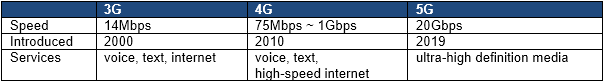

Korea boasted the fastest internet speed over 13 quarters until

2017. In 2019, Korea's internet speed ranked 30th. As the 3rd

generation and 4th generation communication networks were

established in Korea before most countries, as time passed, other countries

installed more advanced technology-based communication networks providing faster

internet and edged ahead of Korea. However, Korea was the first to

commercialize high-quality 5th generation communication network so it is likely

to recover first-rank status again soon.

Online Content

As the speed of internet increased, it created an ecosystem for the growth of online streaming. As there are no location and time restrictions to online streaming creates more demand for its content. The Z generation, which is comfortable with digital environment with the growing content to choose from also contributes to the demand.

Streaming Music

After MP3 players were introduced and replaced most of portable music devices, the music industry discovered new emerging problems. Initial issues were the decrease in CD sales and poor returns on massive investments in music albums. One solution to this problem was to create a ‘Digital Single Album’ which contains a single digitalized mp3 file song. However, digital single albums did not solve the core issue which was free uploads that violated copyright. The music industry had to make major changes to overcome these new developments. These problems encouraged the music industry to take advantage of streaming, which turned out to be a great success. Compared to videos, live media sound data files are smaller and much easier to stream. Live streaming solved most of the issues that were plaguing the music industry but also changed the consumers. After moving on to streaming, consumers did not have to wait in line or stay over-night in front of a store to be the first to listen to a new album. Moreover, the Golden Disk Award (Korean Music Award) changed its evaluation ratings from ‘album sales’ to ‘music streamed.’

There are currently three main music stream services Melon, Bugs Music and Genie Music. Melon is the number one music service provider and has services connected with other favorite contents like Kakaotalk and they offer a discount for SKT telecom mobile services. Bugs Music, the oldest of the three has the most albums.

Streaming Video

Over the Top (OTT) video streaming was first introduced to the public in 1999 by ‘Hananet’ and ‘DreamX,’ but due to the slow streaming speed and poor quality, it did not take off. As transmission speeds began to grow, it was possible to provide video streaming with speed and quality. In 2016, a survey by a mobile app ‘CashSide’ revealed that out of 1,173 viewers about 75% watched two or more videos every day and within the 75%, 34.4% watched 2~3 videos, 21.8% watched 4~5 and 18.4% watched over 10. Youtube has the largest streaming market in Korea but other Korean platforms are growing and challenging Youtube to become number one.

The freedom to choose content and time that suits the viewer is one of the most significant advantages of the streaming media. Also, the consumption pattern and media trends for streaming consumers are changing and they now enjoy ‘Snack Culture’, contents which are short and natural like a snack. As internet streaming grows, television viewing is decreasing. Some elementary school students do not know famous movie stars or past presidents but remember all the favorite live streamers.

l Web/Portal Based

Streaming

1.

Afreeca TV: Afreeca TV is the domestic leader in live broadcast

streaming. As a broadcasting system, it requires an open chat room where the

viewers have instant interaction with the Streamer (also known as Broadcasting

Jockey in Korea). Similar to Twitch, Afreeca TV has a donation system to ‘shoot

stars’ to the streamer you would like to support which, along with advertising is

a revenue source.

2.

Naver (TV cast): Naver is the number one Korean portal website

that gives it a strong brand image, interaction and connections. Naver started

developing the streaming platform in 2015 with highlights from sports events

such as baseball, soccer and other sports. Naver expanded into three types of

platforms. The first is ‘TV cast’ which focuses on sports highlights, e-sports

and comedy. The second is ‘Playleague’, a subcategory of TV cast but based on

user content. The third is ‘V app’ which is a platform for celebrity live

broadcasting. V app is a mobile-based platform essential for fans of K-pop or

K-culture.

3.

Kakao TV: Kakao is one of the most popular mobile messenger apps

in Korea, similar to ‘Whatsapp’ in the U.S. Daum TV was the name of the initial

platform but after the merger of Kakao and Daum it was changed to Kakao TV

because of the brand power. Kakao TV focuses on videos and live internet

broadcasting allied with new major broadcasting companies. The most significant

advantage is that consumers can simply and directly share media through their

messenger platform.

l OTT/VOD

Based Streaming

1.

Whatcha: Whatcha is similar to Netflix but is a startup company

that provides service at a lower monthly cost. Like Netflix, Whatcha creates a

recommendation algorithm for users based on viewing patterns.

2.

Tving & Pooq: Tving and Pooq are both known for their content

businesses. Tving provides contents from CJ E&M, which is running the

largest K-culture businesses such as tvN & Mnet dramas, music videos, movies,

comedy and other types of shows. Pooq is a joint investment by all the

terrestrial broadcasting companies.

3.

Mobile Carrier Streaming: One of the best ways for users to

consume more mobile packet (data) is large video media, which accounts for a significant

portion of data. Therefore, to encourage data usage, all three major mobile

carriers (SKT, KT, LGU+) have been developing new and exciting platforms. With

the penetration of smartphones, the mobile carrier streaming industry is proliferating.

A.

LGU+ started in May of 2015 with a business platform and held the

higher ground compared to the other two companies with the most contents.

B.

SKT started after LGU+ with live TV, VOD, video clips, sports and

movie contents with a platform named Oksusu.

C.

KT started most recently in 2016 with ‘Dovido.’ Dovido is a

compound word of do+video+do, which can shoot, edit, upload and make videos on

one platform.

l Social

media

Until

recently, the most popular social media was Facebook but this has changed. A

‘Report on Social Media and Search Portals in 2018’ by Open Survey stated that

compared to the previous year the users of Youtube as a social media had

significantly increased becoming the most used followed by Instagram, Facebook

and Naver post/blog.

Opportunities and Risks

The online streaming industry has also shown potential for growth in other industries. As online streaming of music has increased the demand of complimentary products such as AI speakers, content media streaming can generate interest in domestic products and Korea itself.

There are great risks as well as major distributors such as Netflix and Spotify can dominate the market while suppressing and controlling contents. There is also conflict with existing media. In the past, movie theaters and TV shows enjoyed a time buffer before it was released online. However, Netflix is releasing movies at the same time as theaters which might destroy the existing markets. Lastly, regulations regarding Korean media are strict compared to other global leaders. This will open the door for overseas media development while the domestic contents will have to contend with regulations and standards which are not a problem elsewhere.

Korea has high internet speed, wide adaptation of smartphones and many early adopters. Developments are ongoing even as we speak. In the subways, everyone has their face buried in their smartphones watching something. Live streaming is becoming a part of everyone’s life.

With Covid19 spreading, social distancing turning mainstream,

usage of online streaming increased. Untact (a term created to emphasize absence

of contact) activities are growing and online streaming contribute a major part

into it. Instead of meeting someone or going out for a drink, people tend to

stay home and watch movies, dramas, or other streamers contents. The growth of

online streaming was already significant but with Covid19 working as a catalyst,

the sky is the limit.