Forecasting

the Pork Market in Korea

Pork

is the most popular meat in Korea and the market is huge with 1.4 million tons

(US $5.4 Billion) consumed in 2018.

However, the market is changing buffeted by conflicting forces. This makes forecasting future market

opportunities difficult. The following

trends can help shed some light on the future potential for the market.

African

Swine Fever (ASF) is a serious viral disease afflicting pigs that can spread

very rapidly among the pig population. Market insiders watched carefully as ASF spread

across Asia and approached Korea. ASF first

appeared in China in August 2018 and then reached North Korea in May 2019. The

first cases were detected in South Korea in September 2019.

Korean

pork importers anticipated the impact of ASF and built up stocks expecting that

the disease would result in a significant culling of the pork population and

thus driving up prices. In China, pork

prices rose 40% after ASF hit the country.

However, in Korea, when ASF finally arrived, the market behaved exactly

the opposite of their forecasts and pork prices have fallen. How could market insiders be so wrong in

their forecasts?

Pork

Remains the Most Important Meat Source

Pork

is the most popular meat among Korean consumers followed by chicken and beef. Pork

consumption per person has been increasing steadily from 5 kg annually in the

1970’s to 25 kg in 2018. However, beef and chicken consumption are currently growing

more rapidly than pork. Meat consumption has grown at 4% CAGR over the period

2008-2017. This breaks down as follows: beef: 5%; chicken 4%; pork 3%.

Source:

Korea Meat Trade Association

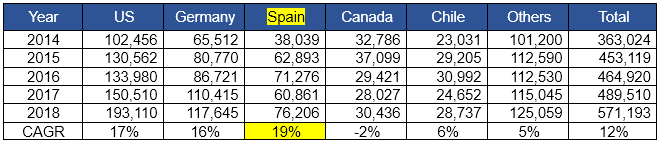

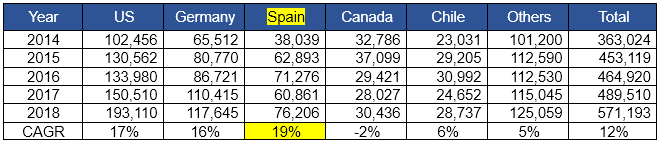

Pork Imports by Country by Value

When looking at entering the Korean market, it is risky to make assumptions based on experience in other markets. It is critical to understand Korea's specific market dynamics and adjust your strategy accordingly.

Consumers

Shift Away from Pork

As

Korean consumers' incomes grow, more and more are looking to beef which is

considered a premium meat. Also, chicken is considered a healthier alternative to

pork. A common assumption in Korea is that white meat such as chicken and duck

is healthier than red meat.

Another

important change among consumers is that consumers are increasingly reluctant

to cook pork at home because of the mess and smell. The most popular cut is pork belly which is

considered the tastiest (due to the fat layers) and most compatible with Korean

barbecue cooking methods. However, when pork is barbecued, the fat splatters all

around the cooking area. Also, the

residual odor from cooking pork remains for many days. Opening windows to reduce the odor is

unwelcome in the cold Korean winters.

Korean

consumers have been migrating to healthier and cleaner dishes in recent years. Furthermore,

consumers have responded to the arrival of ASF by reducing consumption of pork

out of fear of contamination. Therefore,

pork prices are responding to reduction in demand rather than shortage of

supply.

Premium

Pork

Over

the past 10 years, consistent with the shift towards quality, different species

of pork have been introduced to the market as premium pork. For example,

Iberico from Spain, Jeju Black pigs from Jeju Island and Mangalica from

Hungary.

Among

the newly introduced species, Jeju black pigs and Iberico from Spain have

achieved big success. The success of Iberico has led to growth of the pork from

Spain.

Pork Imports by Country by Value

Unit: USD 1,000

When looking at entering the Korean market, it is risky to make assumptions based on experience in other markets. It is critical to understand Korea's specific market dynamics and adjust your strategy accordingly.

If you

would like to identify and capitalize on business opportunities in Korea, let

IRC Guide your Way! www.ircconsultingkorea.com,

Dave at ydy@ircconsultingkorea.com

No comments:

Post a Comment